Frequently Asked Questions about Banco Finantia

Is Banco Finantia a safe bank?

Yes, Banco Finantia is a bank with specialized experience in Private Banking and Corporate and Investment Banking, with a record of profitability and financial soundness ratios above the Portuguese and European averages. In addition, the high international rankings, the awards received over the years and the high satisfaction rate of its customers attest to its reliability.

When was Banco Finantia founded?

Finantia's activity began in 1987 as a financial services company. In 1988 he became an Investment Company and in 1992 he became a bank.

Is Banco Finantia Portuguese?

Banco Finantia is a Portuguese bank, majority owned by private national capital that has internationalized through subsidiaries, with presence in Spain, United Kingdom, USA and Malta.

What is the size of Banco Finantia?

As of march 31, 2024, it had approximately €2,483M of assets, more than €484M of equity and approximately 250 employees, on a consolidated basis.

About Deposits

How do I know if an transaction is a deposit?

Prior to the sale of a deposit, the Bank will provide you with a standard information sheet (in the case of simple deposits) or an information prospectus (in the case of indexed or dual deposits), with the characteristics of the deposit you intend to contract. All the characteristics foreseen in the standard information sheet and in the informative prospectus are also included in the deposit agreement, which is delivered at the time of contracting.

Does the Deposit Guarantee Fund (FGD) guarantee my capital?

The FGD guarantees the repayment of all deposits in each credit institution, up to a maximum limit of EUR 100,000 per each titular holder. The ceiling applies to the total value of the balances of each depositor considering all the deposits made in each bank.

When a deposit is marketed, the Bank must provide you with a Depositor Information Form (FID) with information on the protection of the deposit and inform you of whether the deposit contracted is eligible for the guarantee provided by the FGD. The participating institutions must also confirm that their deposit is covered by the guarantee provided by the FGD by including a reference to the FID in the statements of account, and this sheet must be provided at least once a year.

Are deposits at Banco Finantia covered by the guarantee provided by the FGD?

As one of the banks participating in the FGD, deposits made at Banco Finantia are covered by the guarantee provided by the FGD, under the terms of the FGD regulations.

What is the minimum amount for setting up a time deposit?

The minimum amount to make a deposit in Banco Finantia is €50.000.

In what currencies can term deposits be made?

Term deposits may be constituted in euros or dollars.

How are interest calculated and paid?

Interest will be paid by credit to the associated deposit account. The maturity date of the interest credit in the Demand Deposits account is the same day.

What happens with the interest obtained from the term deposit?

Obtained assets are credited to a current account, and are fully available to the customer.

Can I redeem a deposit at any time?

Yes. Banco Finantia allows repayment in advance, partial or total. If the repayment occurs on the date of payment of interest there will be no penalty. At any other time, early repayment carries the full penalization of the interest for the period on the repaid capital.

Can interest on a time deposit be capitalized?

Deposits at Banco Finantia do not capitalize interest.

Can I increase the amount of my current deposit?

Only if agreed by the parties to the contract.

What tax should I consider as applicable to my time deposit?

The proceeds of the term deposit are considered income from capital and in general taxed by withholding tax at the rate of 28%, with a tax on IRS and considered as IRC account payments. This clause is a summary of the tax regime at the date of commencement of the Subscription Period, which may be changed during the period of this deposit. The regime described above does not prejudice the application of any double taxation agreements to persons or entities not resident in Portugal. Please consult the applicable legislation. (*) in Portugal.

Can I open a deposit account without coming to the bank?

Yes, through the protocol we have signed with CTT.

Can I access my account information through Homebanking?

Access your account via Online, 24/7; by telephone or by direct contact with your account manager.

What type of information is available via Homebanking

Check balances, follow up on recent transactions and deposits, save and print statements, transfer money online safely up to a €10.000 daily limit.

How can I change my primary address, phone number or email address?

Through the email linked to the account, you can request the requested changes in writing.

Can I transfer funds to an international account?

Yes, I can.

Can I order a transfer on a holiday, Saturday or Sunday?

Sign in to your account and schedule transfers to an external linked account at your convenience - holidays and weekends included. The transfer will be processed the next business day. If the transfer is scheduled to occur on a non-business day, it will be done the next business day. If you have any questions, please contact us, call at the number: +351 707 788 080 from Monday to Friday, from 9am to 6pm. You can also write to Banco Finantia, Apartado 43001, 1601- 301 Lisboa.

Service

How can I open a deposit account?

You can open an account in several ways. In Lisbon at our headquarters at Rua General Firmino Miguel, No. 5 – 1st floor or our agency at Avenida Fontes Pereira de Melo, N. º 14 A. In Porto at Rua São João de Brito, N. º 605 E. In Spain you can also choose to open an account in our Banco Finantia Spain in Madrid at Avenida Menéndez Pelayo, 67, Barcelona in Paseo de Gracia, 8-10 2 º 1a) and Valencia at Calle Colón, 60 8 º a. You can also head to a CTT counter and deliver the documents for this purpose.

What documents are required for account opening?

The documentation required for account opening is as follows:

- Citizen CardOnce the account is opened, it can then constitute a term deposit.

Is it necessary to have some kind of bond to the bank?

No additional link to Banco Finantia is required to have a checking account with us.

Can I have more than one holder on my account?

Yes.

How can I move my account?

By cheque or bank transfer (subject to the current price).

What are the conditions for moving an account?

Depending on the account ownership regime, the following account movement conditions are defined:

Individual - in the name of a person, being handled only by himself or his legal representative;

Solidary - in the name of several holders and subject to the solidarity regime, in which any of the holders can move the account without previous authorization of the rest;

Joint-account - in the name of different holders subject to the system of conjunction, in which the deposited amounts can only be handled by all holders;

Mixed - account made up of different holders that show solidarity and conjunction bonds, and whose conditions of movement must be defined in writing by all holders.

Does the account have maintenance expenses?

Customers with an overall involvement of €50,000 or more are exempt from any maintenance costs.

Investment Advisory

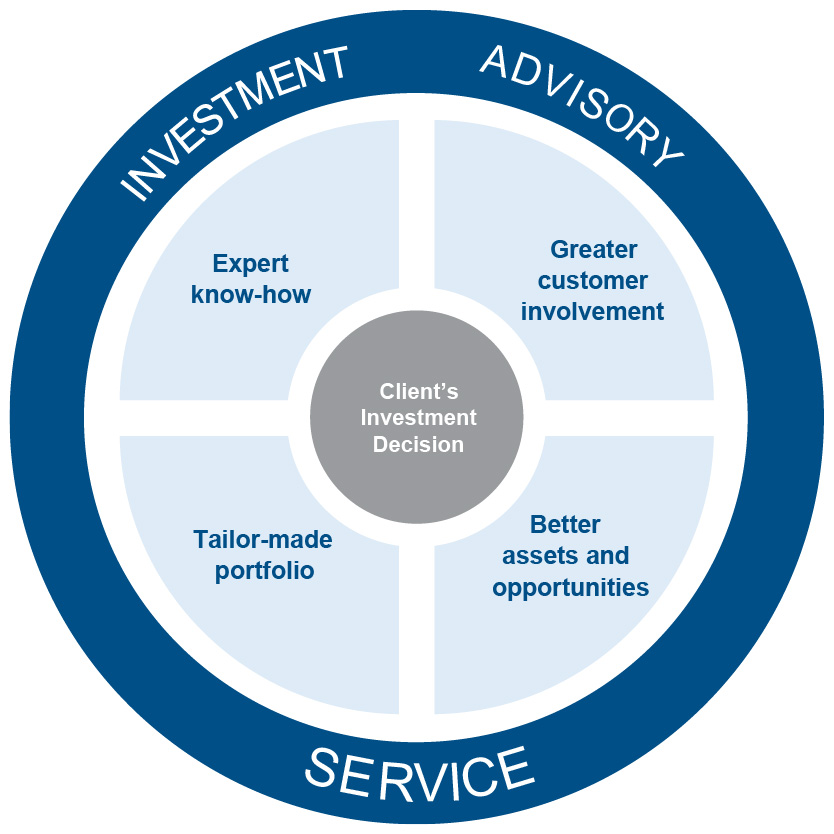

What does Banco Finantia’s Investment Consulting service consist of?

It is a personalised advisory service, provided to potential or effective customers, in the context of carrying out transactions related to specific financial instruments. It can be directly requested by the customer or proposed at the initiative of the customer’s Private Banker, as an instrument to support investment decision making, with the final decision always being the customer's.

Why a consulting service and not just a marketing service?

Because the marketing (order-taking service) of financial instruments does not involve any value judgment. On the contrary, it only requires that information be provided on the characteristics of the instruments, receiving the instructions from the customer without issuing value judgments. We recommend the use of the order-taking service only for our more experienced customers.

On the other hand, Investment Consulting consists of the issuance of investment recommendations by a Private Banker, ensuring that these are personalised, individual, and adjusted to the personal circumstances of each customer. In addition, these are reinforced by the vast experience of the Banco Finantia professionals and grounded on analytical resources and constant market monitoring.

What services does Banco Finantia’s Private Banking make available?

In addition to Investment Consulting, Banco Finantia’s Private Bankers may also:

- Receive and execute securities transaction orders based solely on the customer’s instruction, without the need for specialised advice

- Act as custodians of financial assets

- Inform about solutions of term savings in EUR and USD

For additional information regarding this service, consult the Private Banking - What we do page.

Why is it called “Non-Independent Consulting”?

Legislation establishes that the Independent Investment Consulting service can only be considered as such if three conditions are met:

- There is a capacity to value a sufficiently diverse range of financial instruments available on the market

- There is an advisory service for financial instruments issued and marketed by the financial intermediary and third parties; and

- The non-acceptance or receipt of any remuneration, commission, or benefit, paid or granted by a third party, except for non-pecuniary benefits of an insignificant amount.

Non-independent consulting such as that provided by Banco Finantia is legitimised by adding value to the service provided, translated into benefits for the customer, both in terms of the quality of the accompaniment, as well as at the level of full access to the support and analysis resources provided by the Bank.

How are the interests of customers/investors guaranteed?

The Markets in Financial Instruments (MiFID II) Directive introduced a set of measures to reinforce the pursuit of the customer's interest above any circumstance, increasing the transparency and quality of the service and mitigating situations of conflict of interests. It establishes rules on how financial institutions relate to their Customers and, naturally, how they market their investment products and services. Of these, we highlight, for example:

- Reinforcement of information duties to Customers

- Reinforcement of rules on matters of conflict of interests

- More detailed criteria in order execution

- New transparency rules for the market

- Greater focus on the code of conduct and on the appropriate professional skills of employees (knowledge and experience)

Before making any investment recommendation, your Private Banker will carefully evaluate which investment products and services to offer, considering an analysis of your knowledge and experience, but also of your financial situation, investment objectives, needs and tolerance to risk.

What are the inherent risks that should be considered?

Any investment in financial instruments involves risks that the customer must consider:

- The value of the capital invested may be subject to fluctuations that make it impossible for the investor to recover the amount initially invested, depending on the valuation of the financial assets that make up the customer’s patrimony.

- Past returns are not synonymous with future returns and, for example, the foreign exchange risk reflected in the fluctuation of exchange rates between currencies can be negatively reflected when the value of the initial investment is recovered.

- Each financial instrument carries specific risks.

Nevertheless, Banco Finantia does not market its own products.

What are the advantages of the Investment Consulting service provided by Banco Finantia?

Reputability: it does not market its own financial products, having at its disposal a wide range of assets that it can recommend.

Experience: it has extensive experience in dynamic and constantly changing environments, having as its main cornerstone the preservation of the customer’s patrimony.

Value proposal: it provides an additional service according to the desired level, whether in the acquisition and sale of selected securities investment funds or of bonds and shares.

Personalisation: it develops tailored solutions, considering risk tolerance and the specificity of each investor risk profile, based on their knowledge, experience and financial capacity. It outlines fully personalised and appropriate investment strategies, considering the investor’s personal circumstances, socio-economic context and, of course, the intended investment objectives.

Specialisation: Banco Finantia’s Private Banking consultants have the necessary knowledge and experience under the terms required by the Comissão do Mercado de Valores Mobiliários (CMVM) (Portuguese Securities Market Commission).

Accompaniment: investors will be accompanied by a specialised Private Banker, at their disposal throughout each step of the process. In addition, Banco Finantia’s market specialists will regularly monitor their investment portfolio.

Involvement: it allows greater customer interaction in the management of their patrimony, to guarantee a service that is truly tailored to their expectations.

Flexibility: investors can keep track of their investment portfolio, anywhere and anytime, through the home banking service FinantiaNet.

Extensive knowledge of the bond market: knowledge of the bond market: advantage of know-how in the bond markets for public, financial, and corporate debt, covering a wide range of issuers which risk levels are classified by the main rating companies in the sector as investment grade and high yield.

For additional information consult the "Other Compulsory Information" page or the CMVM website.

Investment Funds

What are investment funds?

The investment units of an Investment Fund are financial instruments that result from the raising of capital from several investors. Together, these amounts constitute an autonomous patrimony, managed by a management company that applies them in a variety of assets, which may include bonds, shares, money market instruments or even commodities, such as gold or oil. Banco Finantia markets investment funds managed by three of the most renowned management companies worldwide.

What are the advantages of investing in investment funds?

These financial instruments allow:

- Accessing markets, assets and opportunities that would otherwise not be available to most investors.

- Guaranteeing the diversification of investments, distributing them among different securities, markets and even currencies, to contribute to a general risk reduction.

- Investing in the medium/long term, with the possibility of benefiting from the high liquidity provided by most funds.

- Ensuring that asset management is carried out by specialists dedicated to the individual performance of each fund.

What types of Investment Funds does Banco Finantia market?

Bond Funds portfolios predominantly constituted by bonds (debt securities) issued by companies, private or public, or States or government entities. They are traditionally less susceptible to risk.

Equity Funds portfolios predominantly constituted by shares of companies, national and international. They can generate more attractive returns, but are also, by definition, traditionally associated with higher risk.

Money Market Funds portfolios predominantly made up of money market instruments, such as time deposits and investment securities with a maturity of less than one year.

Index funds reproduce, permanently, in whole or in part, a given index.

Guaranteed Capital Funds have associated guarantees for the entire capital and, possibly, for a certain income profile.

Structured Funds at predefined dates - allow investors to make gains based on algorithms associated with results, price changes or other conditions of financial assets, indexes or benchmark portfolios or collective investment organisms with similar characteristics.

Flexible Funds do not assume any commitment regarding the composition of the patrimony in the respective constitutive documents.

Who can subscribe to a fund in Banco Finantia?

The investment funds made available by Banco Finantia can be subscribed by investors, individuals and companies, considering their different risk profiles.

How can one subscribe or redeem a fund?

Subscriptions are processed on the customer's instructions. The subscription order is made with an “open quote”, that is, depending on the fund in question, only a couple of business days following the order (as a rule, on the 1st or 2nd business day thereafter) is it possible to know the number of participation units effectively subscribed.

The fund may be redeemed (in whole or in part) based on a request by the customer. Depending on the fund, this is processed at the value on the redemption date, which as a rule will only be known the day following that of the request.

In either case, subscription or redemption requests can be made in person or by email to your Private Banker.

What to consider in terms of taxation in respect of an investment fund?

Income from participation units of national investment funds obtained by individuals resident in Portugal is subject to withholding tax at a levy in discharge rate of 28% (with the option for inclusion), with capital gains arising from the redemption of participation units being subject to withholding tax at a special definitive tax rate of 28%.

In the case of income paid to resident investors that are legal persons, it is subject to a withholding tax of 25% paid on account. Non-resident investors earning income from domestic securities investment funds, including capital gains resulting from the respective redemption or liquidation, are exempt from IRS (Personal Income Tax) or IRC (Corporate Income Tax).

In the case of foreign investment funds, there will be taxation at the rate of 28%, under IRS, on the income distributed on the participation units and on the capital gains resulting from the onerous sale or redemption of the participation units, obtained by individuals resident in Portugal.

This text is a summary of the applicable tax regime and does not exempt one from consulting the legislation in force.

What are the risks potentially associated with investing in funds?

As with other financial instruments, investment funds are also susceptible to different levels of risk, depending on their type and investment portfolio. Investment Funds do not offer a guarantee of return, since it is not possible to anticipate the income generated in the future.

As a rule, the higher the risk level of a Fund, the greater the potential for appreciation. However, the risk of loss of the invested capital will also increase proportionately.

It will be important, for example, to consider market risk, derived from natural price changes in the specific markets in which each fund invests, as well as, when applicable, exchange rate risk (exposure of the fund's currency value to the evolution of the EUR). Both can generate gains, as well as give rise to losses.

Which entity guarantees the regulation of Investment Funds?

Investment funds are a regulated financial product and are subject to registration and supervision by the Portuguese Securities Market Commission (CMVM). The CMVM is responsible for assessing that the financial intermediaries make periodic information about the Funds available to the respective investors, as well as all other relevant information, constantly updated.

For more information, it is suggested you consult the document “Additional information for Customers”.

Custody Service

What is a securities account?

It is the account through which the financial intermediary will receive orders on financial instruments (purchase, sale, subscription, redemption) from investors. It is in the securities account that their book-entry financial securities (bonds, investment fund participation units, shares, among others) will be registered, that is, the securities represented by computerised account records (and not by paper documents).

What is a financial intermediation contract?

The opening of a securities account requires the celebration of a financial intermediation contract, which, legally, must be in written form. The financial intermediation contract must contain, among other elements, a description of the services to be provided (as well as an identification of the financial instruments that are the object), an indication of the rights and duties of the parties and of how to raise complaints.

Note: This information can be found on the CMVM (Portuguese Securities Market Commission) website, with financial additional information.

How does asset-custodianship work?

Asset-custodianship works through the custodian, who acts as a “central depository” for the securities held by the investor. For shares to be traded between two investors, they must be deposited in the clearing system. The custodian sends all the information on the investor, to give more transparency to the asset negotiation process.

Who are the intervening parties in asset-custodianship?

They are the depositary institution, the custodian and the investor.

What is the Investor Compensation Scheme (ICS)?

The ICS was created to protect investors if a participating entity does not have the financial capacity to repay or refund the money or financial instruments that belong to them.

It guarantees the amounts due to investors by a financial intermediary (bank, brokerage company, asset management company, investment fund management company) that is a participant in the ICS and that lacks financial capacity to repay or refund:

- Financial instruments (shares, bonds, investment fund units, among others) deposited by or managed on behalf of clients;

- The money deposited by clients, expressly intended to be invested in financial instruments (including credits arising from investment transactions whose contractual conditions establish a money-back guarantee).

The maximum indemnity limit is € 25,000 per person (applicable to the sum of the investor's shares in the various accounts in which he is the holder), regardless of the number of accounts in which the investor is the holder and the number of holders of those accounts.

The amount of compensation is calculated based on the value of the assets (cash and financial instruments) at the date of activation. The ICS does not compensate losses deriving from investments in financial instruments.

Who can benefit from the ICS protection?

The purpose of the ICS is to protect small investors, excluding "institutional" investors, namely credit institutions, financial companies, financial institutions, insurance companies, pension fund management companies and entities in the public administration sector, among others.

The investor can benefit from ICS coverage if the following assumptions are made cumulatively:

- a) The defaulting financial intermediary is an entity participating in the ICS;

- b) The investor is eligible for coverage purposes;

- c) The investor's credit is eligible for coverage purposes, that is, it refers to covered financial instruments or cash transferred to the financial intermediary (FI) with the express intent of investment in covered financial instruments.

Will my securities portfolio (bonds, investment funds, shares) be protected?

Financial intermediaries must safeguard clients' assets, so they must be properly segregated from the assets belonging to the financial intermediary in the accounting and operations records.

If the FI does not return the securities to the client, these amounts are covered by the ICS, up to a maximum amount of € 25,000 per investor, as indicated.

The ICS does not cover stock market devaluations, that is, losses resulting from the normal functioning of the capital market. Nor does it cover the risks arising from the investment of the Investment Funds, nor the failure of the depositary of the Funds to fulfill its obligations.

There are limitations on protection for a particular type of customer.